Michael’s CIO (Check-It-Out) Report on the week just past — events, sarcasm, and global macro reflections

August 1, 2022

THEME: CHiPs, rece??ion—I want my MeTaVerse

GL🌍BAL

Tug of War: The U.S. Federal Reserve and the European Central Bank are in a tug of war! Not with each other, but with inflation. They want to raise interest rates to some “neutral” rate that curtails inflation but doesn’t pull their respective economies into recession—⚠For those that have played tug of war, victory is rarely a gentle feat

FedUp: The Fed raised interest rates again by 0.75%, further fueling U.S. dollar strength in global markets—Global recession concerns lead to dollar strength as a safe haven, but then a stronger dollar heightens recession concerns 📉😟💸—A less aggressive Fed or a revived Chinese economy (where urban youth unemployment is above 19%) could temper dollar strength

Rece??ion: “C’mon man,… Don’t call it a comeback!” Don’t call it a recession, either! The US economy shrank for two consecutive quarters with inflation undermining consumer spend and Federal Reserve interest-rate hikes slowing business and housing activity—With sentiment levels quite low, investors may be receptive to any positive developments limiting a severe recession, or in the words of LL, not allowing tears to “rain down like a monsoon”☔

BottomsUp: Despite all the above, U.S. stocks performed well in July—Bottoming is a process and during this year’s downtrend we have already seen three bounces up of +10% before stock indices rolled over to new lows—Some investors seem to be fighting the Fed, not believing it will keep raising rates in a Don Quixote like battle with inflation🤺🎠

COMMOdity COMMOtion: Oil, energy, and agricultural price dynamics have not been solved and remain a visible problem, especially for less developed/emerging countries—Food and energy prices are caught between carbon, chips, climate, conflict, deglobalization, and geopolitics—Some of these problems compound because natural gas and coal are used to create ammonia for nitrogen fertilizer🌱 (Note: we wrote about this back in September 2021)—Private commodity funds may be a way to invest through this

South Africa: A year after the Zuma riots, S.A. has a 45% unemployment rate (including those who have stopped looking for work) and for those under 24 its 64% jobless—Former president Thabo Mbeki warned of a possible uprising which in and of itself could be a signal—President Ramaphosa might not be in leadership next year

wHEALTH

Tax planning: Tax specialists can help provide one with tax-efficient structures and investments, optimize withdrawals, and disclose other approaches to reduce taxes—Always a nice idea for your family and legacy😊

Family legacy planning: Prepare your family for the conscientious responsibility of inheriting wealth—Without a comprehensive and unbiased view, it’s difficult to make informed and strategic investment decisions to preserve capital, grow, and maintain family wealth and health

BIZNOMIC$

Earning$: This earnings season, companies have on average reported earnings +2.4% above expectations with 68% of them doing better than expected. Positive, yes; but below the 5-year average of +8.8% earnings beat and 77% doing better than expected—There has been a softening of results that we expect to continue

Altein: Alternative proteins made with non-animal sources experienced explosive growth over the past decade; however, the industry faces pressure from incumbents, new competition, and inflation. New startup deal values are down 62.6% from their peak in last year—But then again, most startup values are down—Private venture capital funds may soon look appealing again😏

Gh👻sted: Pasadena based ghost kitchen company, Kitchen United, raised $100MM series C venture round (from the likes of Kroger, Circle K, mall operator Simon Property, and Burger King’s owner, Restaurant Brands International) to open hundreds of kitchens over the next few years—Ghost kitchens are for pickup or delivery meals🚘

Ponch & Jon🏍: The Creating Helpful Incentives to Produce Semiconductors (Chips) Act, a $52 billion subsidy package for domestic semiconductor chip manufacturing and U.S. high-tech research, passed in Congress—This should be a boon for domestic tech and manufacturing but will take years for results to manifest—Long-term, it will lessen U.S. reliance on Taiwan (and possibly support for the territory)🚨

Spic&Spac: Special purpose acquisition companies (SPACs) face headwinds as failed mergers racks up, many target companies opt to stay private, and the prospect of tighter regulations loom—Many private companies may revert to traditional public listings when markets improve

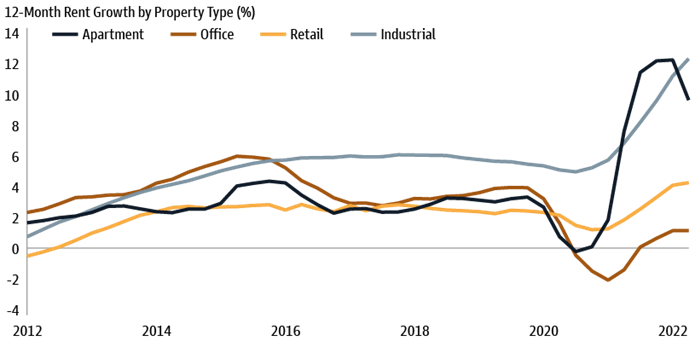

Rent Mix: While 1 and 2 bedroom rentals continue to increase in price across the country, some cities have seen declines: 🏘Charlotte, NC; Chula Vista, CA; St. Louis, MO; McKinney, TX; Norfolk, VA; Cleveland, OH

CONTENT

I want my MeTaVerse: MTV’s Video Music Awards adds a “Best Metaverse Performance” category 👩🏽🚀🎶🌚—Will Metaverse kill the video star?

Buy the dip: To celebrate National Avocado Day, Chipotle’s Buy the Dip promotion (in concert with Coinbase) includes $200K in CRYPTOtle prizes (Bitcoin, Ethereum, Solana, Avalanche, and Dogecoin) and $2MM in guacamole and queso🥑—No chip shortage here🤦🏽♂️

Billionois: One ticket in Illinois won the $1.34 billion Mega Millions jackpot—Insurance NewsNet published some of our thoughts on what the winner should do

Renaissongs: Beyonce’s lucky #7 studio album, Renaissance, is out🎼

PERSONAL

Prime: Running Point and I were quoted by Reuters in an article regarding Federal Reserve monetary policy and Wall Street banks raising their prime lending rates by 3/4% to 5.5%—Expect the prime rate to keep increasing in lock-step with the Fed

LottoNoise: Running Point and I were quoted by Insurance NewsNet in an article regarding what one should do first if they win the Mega Millions lottery💰—A happy thought indeed

Make it a great month😊

Michael

~~~

Michael Ashley Schulman, CFA

Partner & Chief Investment Officer

Running Point Capital Advisors, your family office

“We deliver custom investment solutions, innovations, and unique perspectives to you and your family.”

Disclosure: The opinions expressed are those of Running Point Capital Advisors, LLC (Running Point) and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Forward-looking statements cannot be guaranteed. Running Point is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Running Point’s investment advisory services and fees can be found in its Form ADV Part 2, which is available upon request. RP-22-48