Michael’s CIO (Check-It-Out) Report — events, sarcasm, and global macro reflections

February 29, 2024

THEME: U.S. Equity Outlook 📈🔭

SUMMARY

The S&P 500 is up about 40% since the start of the bull market on October 12, 2022, yet its detractors continue to observe that the run up has been very narrow. They observe that the MegaCap stocks have accounted for most of the gains. But that is not necessarily a bad thing.

BACKGROUND

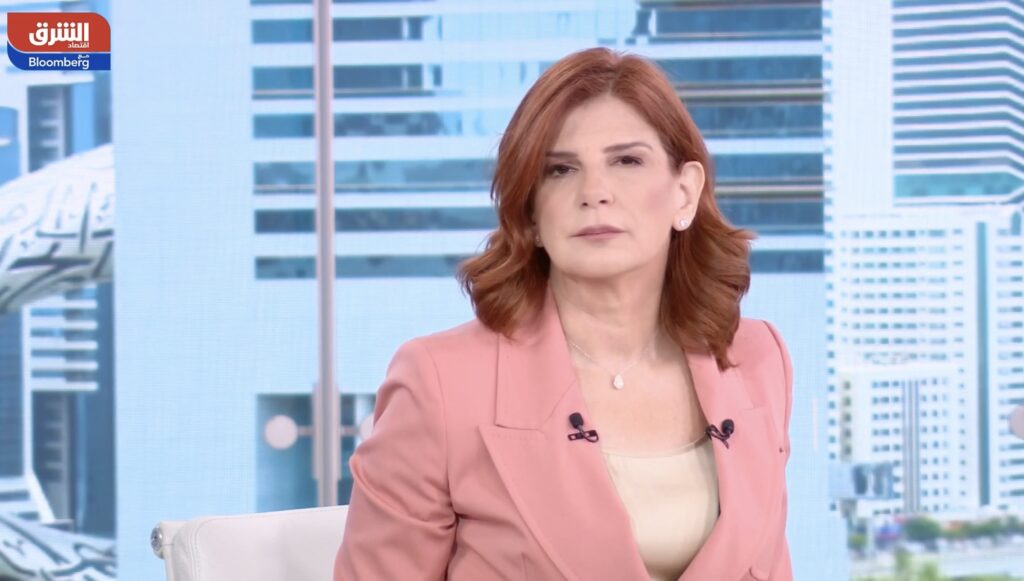

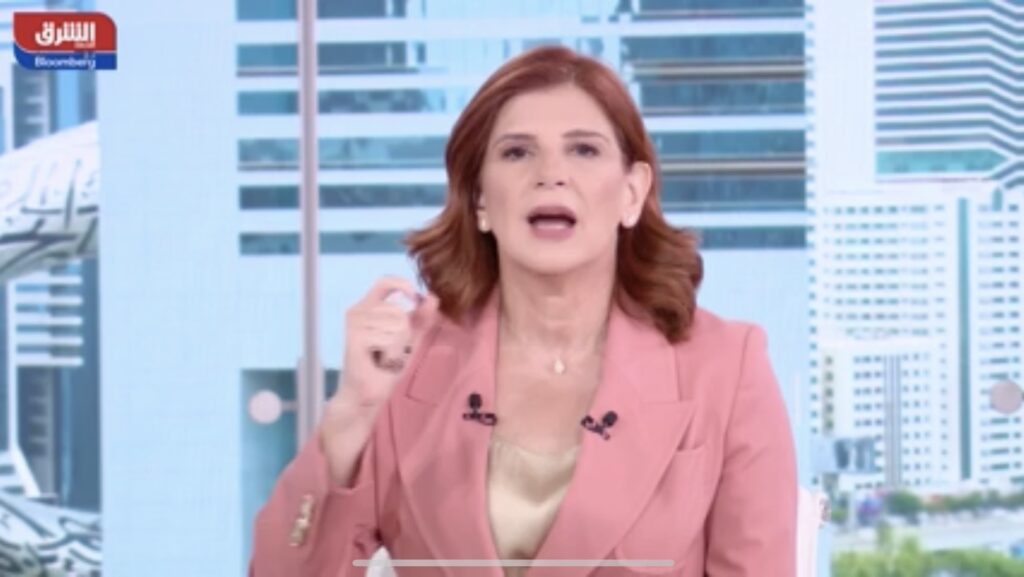

Running Point‘s chief investment officer, Michael Ashley Schulman, CFA, was interviewed by 3x award-winning TV journalist and business morning news anchor Cyba Audi of Asharq Business اقتصاد الشرق News with Bloomberg — in a Thursday morning live TV segment — regarding our outlook on equities and the U.S. stock market.

We touched on interest rates, Fed policy, the U.S. economy, market expectations, and investment implications! The seven and-a-half minute interview is in Arabic; you can view it here and/or read my take on the situation in English in my notes below. Thank you to Cyba Audi, Sarah Al Shawi, Tabarek Jouini, and Asharq Business اقتصاد الشرق!

OUTLOOK

We’ve been in the higher-for-longer camp regarding the outlook for interest rates and the federal funds rate (FFR) since I was on your network in December. That outlook was confirmed by the release of January’s FOMC minutes and Fed speeches. The Fed wants to see more progress bringing inflation down and is in no rush to ease given the strength of the economy. Stocks soared despite this bearish news because of Nvidia’s strong earnings report. In addition, initial unemployment claims remained low, confirming that the labor market is still strong.

THE MAGNIFICENT 6

The S&P 500 is up about 40% since the start of the bull market on October 12, 2022, yet its detractors continue to observe that the run up has been very narrow. They observe that the MegaCap stocks have accounted for most of the gains. But that is not necessarily a bad thing.

Yes, the Magnificent 6 (Alphabet, Amazon, Apple, Meta, Microsoft, and Nvidia) are responsible for most of the S&P500 earnings, but it is an odd rationale for not liking stocks. The Mag 6 are earning their revenue from the rest of the S&P500 as well as most other large companies around the world. Thus, if the Mag 6 stopped charging for their services, you’d see profits rise amongst all other companies; it would just be the same money shifting pockets. As a whole, the market would earn about the same amount, but you would stifle innovation and productivity. Stock markets and the corporate world are not meant to be socialist systems that distribute profits evenly. Besides, maybe it is time a company like Eli Lilly joins this group!

The soccer analogy: Imagine your college or university has a very good soccer team, but then someone says yes, but take away those soccer players and the rest of the college is not very good at soccer! What’s their point? Of course if you take away the best players, the school won’t be very good at soccer. Same thing with the stock market; take away the best companies and of course it won’t look as good. But what is their point? That is not how life works.

THE ECONOMIC PICTURE REMAINS BRIGHT

The economy looks good. The Atlanta Fed updated its GDPNow model. Q1’s real GDP is tracking at a 3.2% annual rate, up from 2.9% on February 16. Real GDP was up 4.9% and 3.3% during Q3 and Q4 last year. And there are plenty of jobs available in the labor market. The Consumer Confidence Index survey reported that the “jobs plentiful” response rate remained high at 41.3% during February. But watch out for rising Treasury yields which may spike again on the back of positive economic data.

Market is overpriced but not horribly overpriced; markets can maintain a relatively high valuation for months or years. Sentiment is bullish, which is probably a negative, but not overly overly bullish. Many Wall Street analysts have called for a recession for a couple years and they still want to be right, even though the evidence has been against them. As they say, even a broken clock is right twice a day.

CORPORATE MARGINS

Corporate margins have expanded over the last decade, partially justifying higher corporate valuations. To protect margins, businesses may reduce headcount as labor costs are stickier than selling prices on the way down. You continue to hear companies announce layoffs in order to maintain their margins. Labor is expensive! Also, geopolitical volatility poses risks to global supply chains, shipping costs, and commodity prices but this is rapidly being factored into projections and part of the reason why inflation remains above the Federal Reserve’s target of 2%.

The further the possibility of recession gets pushed out, the more bullish the view on equities becomes. And when there is a recession, the Fed has plenty of room to lower interest rates to help the economy. You can’t have 7 rate cuts and a soft landing; it’s one or the other, or neither. The January inflation (CPI) report did not make the Fed’s job easier; core inflation clocked in at 0.4% month-over-month, taking the 3-month rate to 4.0% annualized and the 6-month rate to 3.6% annualized. In other words, the economy is still hot.

NOT CRAZY YET

Exclude the mag 6, the rest of the S&P 500 trades at 18x earnings. Yes, the market is kind of expensive, kind of overshot, kind of overexuberant, but not crazy yet. People believe the worst is behind them and the Fed is not going to hike anymore; thus, they will spend their excess savings (but it is tough to model how long they will do that for).

Do not expect the Fed to lower rates any time soon. The economy is strong (growth came in last quarter at 3.2%), unemployment is low, wages have been rising, the 5% interest level we are at now is similar to levels the U.S. had before the great financial crisis (GFC), and inflation remains solidly above 2%. Why would they lower rates? Furthermore—as we approach summer—the longer the Fed delays lowering interest rates the more it might look like they are interfering with a presidential election if they lower them closer to November 2. The thought here is that lower rates would stimulate stocks and make the Biden administration look stronger from an economic perspective.

If the Fed raises rates again, especially going into summer, we could see a major correction. If commercial or office real estate collapses, we could see banks go under and credit shrink; but this is not our likely scenario. The 2022 bear market was a -27% correction. After reaching a peak of 4819 on January 4, the S&P 500 proceeded to fall 27% over the subsequent nine months, ultimately hitting an intraday low of 3492 on October 13. Yes, a correction is possible; but momentum seems to be leading us higher. The term bubble has been thrown around by some observers, but this does not feel like a bubble yet.

HEDGING?

We seem to be in the early stage of a melt-up in equity prices as money comes in from the sidelines with a fear of missing out (FOMO) on additional stock market gains. Pure market hedging using futures and options can get expensive fast as the options expire and need to be renewed. A more reasonable hedge may be to raise some cash for when there is a potential dip, stay fully invested but shift part of your portfolio either into low volatility stocks or into private credit where you can earn equity like returns but be higher up in the capitalization structure and thus more protected.

ROLLING RECESIONS

The economy has proven resilient with rolling recessions in different sectors of the economy, not economy-wide. Over the past couple years, there was a relatively moderate and short recession in single-family housing, but multi-family construction remained strong. There was a relatively long but shallow growth recession among consumer goods producers and providers, while demand for consumer services rose over the past two years. In fact, demand for goods remained relatively flat near its post-pandemic record high and rose to a new record high in December. Now it looks like manufacturing may be at a bottom; the rolling recession for goods producers and distributors may turn into a rolling recovery in coming months.

Pay attention to semiconductor companies as they are bellwethers of global demand—chips are ubiquitous: part of every remote service and nearly every manufactured product—they tend to be early cyclicals and lead other manufacturing industries by 3 to 6 months.

FISCAL POLICY

While most economists over the last couple years obsessed over the tightening of monetary policy, they didn’t correctly account for the stimulative impact of fiscal policy. Legislation passed in 2022 provided a huge boost to spending on public infrastructure and manufacturing facilities and provided construction tax incentives. As a result, private nonresidential and public construction soared to record highs over the past two years, and so did total payroll employment in the construction industry.

Federal government outlays on defense spending have also been boosted over the past two years to a record high of $844 billion over the past 12 month through December. The fastest growing federal government outlay over the past two years has been on net interest paid on the federal debt. That’s boosted the net interest received component of personal income, which hit a record-high $1.8 trillion seasonally adjusted annual rate (SAAR) in December

NEXT STEPS

The positive wealth from housing and stocks has boosted economic growth and inflation—although above the Federal Reserve’s target of 2%—is being subdued by rapid technology and AI enabled productivity growth. Stock indices have continued to rise despite bashed expectations of the Federal Reserve lowering rates. The economy seems to be having its moment, at least until presidential election trepidations and volatility creep into the outlook.

Make it a great week😃,

Michael

~~~

Michael Ashley Schulman, CFA

Partner & Chief Investment Officer

Running Point Capital Advisors, your family office

“We deliver custom investment solutions, family office services, innovations, and unique perspectives to you and your family—we are your family office—you can emphasize your enjoyments, priorities, and legacy.”

Disclosure: The opinions expressed are those of Running Point Capital Advisors, LLC (Running Point) and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Forward-looking statements cannot be guaranteed. Running Point is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Running Point’s investment advisory services and fees can be found in its Form ADV Part 2, which is available upon request. RP-24-33