SUMMARY

- Wobbles: 2022 will be akin to the terrible twos, with short-term political, monetary, and economic wobbles on the path toward long-term progress

- Unwind: No central bank has ever unwound $8.5 trillion of stimulus, and experience with raising interest rates from 0% is limited

- Higher rates: The Fed will likely raise short-term interest rates to normalize policy, but that alone won’t stem inflation — Inflation will dampen when supply chain and labor bottlenecks ease

- StayFlation: Inflation will moderate but remain higher than what we’ve had over the last dozen years— in other words, it is here to stay — in fact, the Fed may use economic growth and inflation to try to save the government from its massive debt burden by inflating it away

- Estates: Tax, estate, and financial plan preparedness are key to moving beyond the investment outlook and having meaningful family office style preparedness and resiliency

- Illiquids: Consider investment structures that take advantage of market uncertainty and inflationary trends

- Roaring 20s: Overall, corporations and consumers have a ton of cash and huge pent-up demand; a wealth and productivity effect is in place that should drive socioeconomic growth over the long-term

DETAILS

We still believe in the Roaring 20s analogy we espoused over a year ago. Long run, markets, capital, and investments should do well through the 2020s on the back of generous government stimulus, supportive central banks, and technological innovation, which will, A) Motivate companies to splurge on capital expenditures to improve efficiencies, and B) Persuade consumers to purchase novel services and conveniences like electric vehicles, augmented-reality devices, and space tourism. More specifically, socioeconomic expansion should continue in 2022, underpinned by solid consumer income and excess savings, corporate inventory rebuilding, and business investment.

2022 will be all right in the end, but shorter-term, we are apprehensive of the terrible twos[i] as Biden’s new-administration honeymoon is long over, his presidency enters its second year, the U.S. prepares for midterm elections, the Supreme Court potentially remakes Roe v. Wade (with a Dobbs v. Jackson Women’s Health Organization decision[ii]), and the world’s stumbling recovery from the pandemic and supply chain malaise continues. Quite frankly, almost every government around the globe is on notice as citizens have endured repetitive shutdowns, cumbersome yo-yo regulations, and changing rules that lack logic. Additionally, there is a philosophical struggle between those forces that believe life will return to the old normal and those that believe it never will. Probably we will settle on some sort of middle ground, but meanwhile expect more wild, emotional (and asset price) swings along the way.

We anticipate another year of solid global growth that will sustain businesses, employment, and inflation. But developed-economy[iii] central banks will start playing Jenga as they calculate how to incrementally remove monetary stimulus (raise interest rates and reduce bond holdings) without toppling the economic towers they’ve assembled.

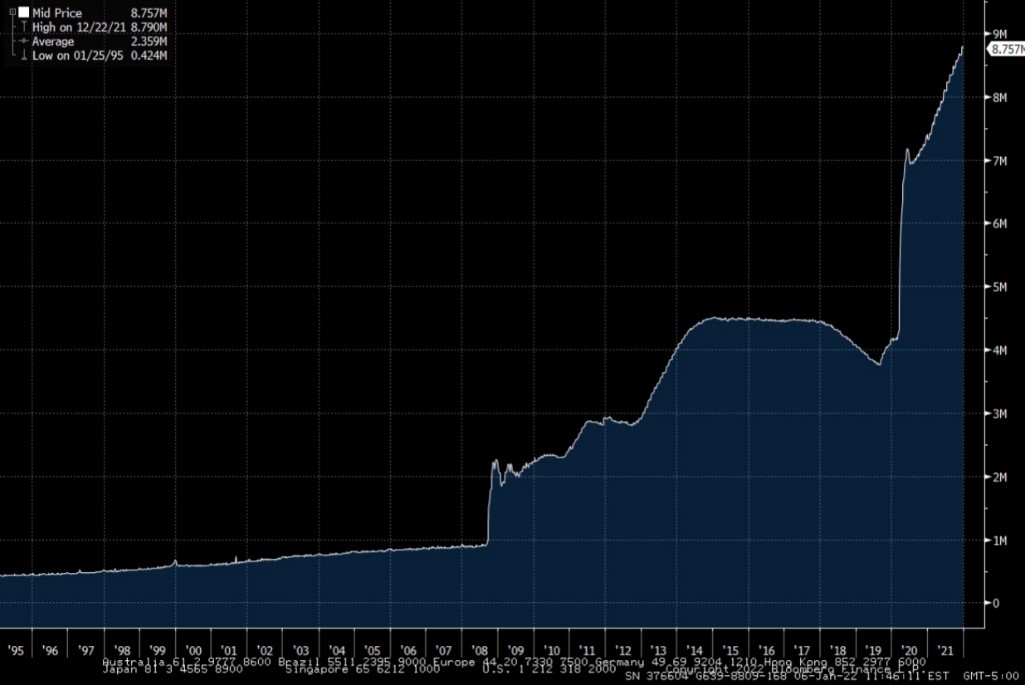

The pandemic era of sweeping, radical, preposterously loose U.S. monetary policy has shifted. Inevitably, investment markets will be affected; the timing, however, is debatable. The Fed has never unwound $8.8 trillion of stimulus programs (see Graph 1), and experience with raising rates from 0% remains limited; therefore, historical statistics on how industries will react are lacking[iv]. Even so, 2022 will be a more turbulent and less rewarding year for investors than 2021 as the Fed raises rates and reduces its holding of Treasury and mortgage bonds.[v] The rise in corporate profits we’ve witnessed over the last 18 months will slow but should remain positive, thereby helping support to debt/credit markets and assets. The economy is so overstimulated that letting out some hot air could be a good thing, and that’s likely what the Fed desires. The real question pertains to investor perception: Will a Fed policy mistake trigger a quick economic deceleration (or recession)? Many investors, asset managers, commentators, and backseat quarterbacks will voice displeasure no matter what the Fed does or doesn’t do.

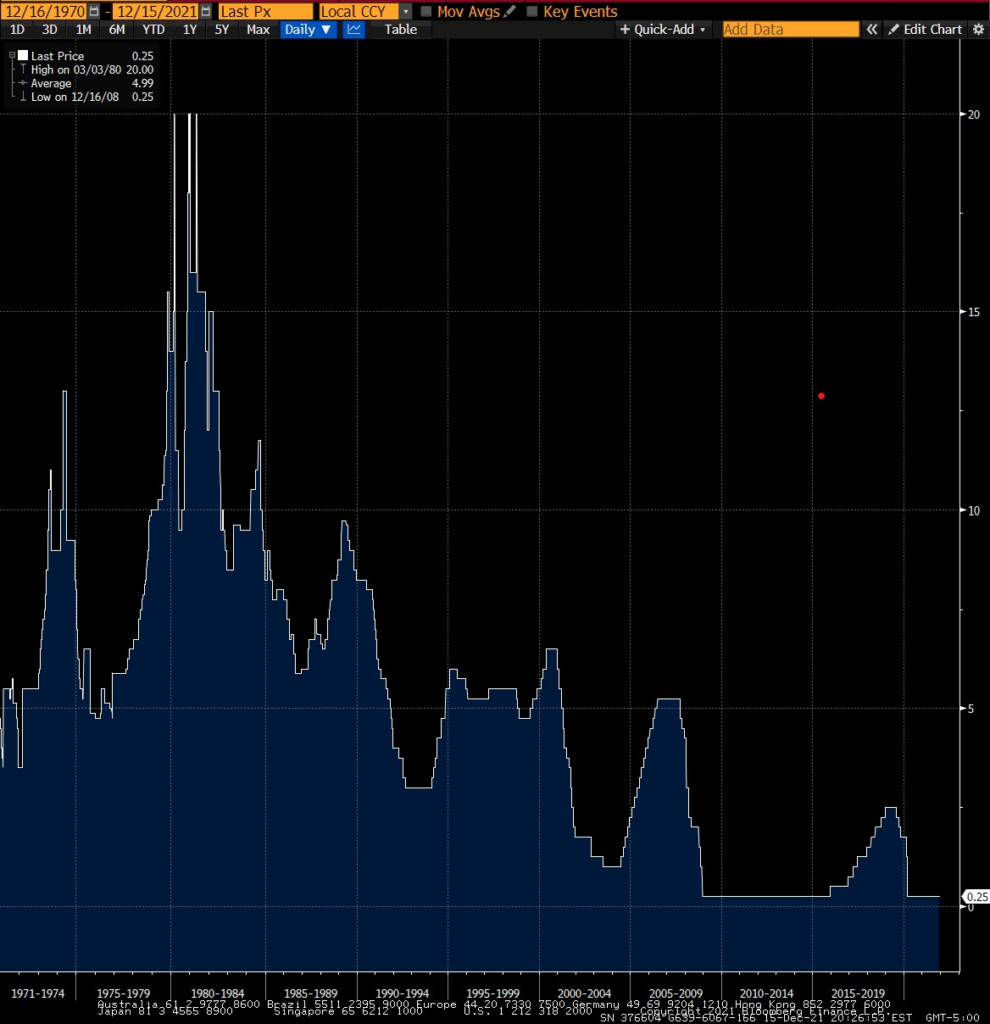

The Fed has merely begun to slow accommodation from immense to modest, but when interest rate pivots like this happen, reporters tend to assume a continuous projection upward in Fed rates; however, since 1980, practically every interest rate rise has topped out at a lower peak rate than previous attempts (see Graph 2): 20% followed by 18%, then 15%, 11.75%, 9.75%, 6%, 6.5% (an aberration), 5.25%, and 2.5% in 2019.

There is a chance this pattern of lower peak rates will continue. Mounting debt and deficits mean the Fed has very little headroom to raise rates, or else federal debt interest payments become an unreasonable burden. However, if this pattern is finally broken, it will probably be because inflation remains high, thereby continuing to suppress real rates.

The enemy of my enemy is my friend. The Federal Reserve’s antagonist is U.S. fiscal debt—now at nearly $30T. The enemy of debt is inflation and economic growth.

Note: If you or a corporation have excessive debt, you want inflation because it erodes the value of that debt.

If the Federal Reserve can thread the needle of maintaining reasonable growth and inflation while raising interest rates, the U.S.’s relative debt burden as a percentage of gross domestic product (GDP) will shrink and become more manageable. (This is akin to outgrowing your debt rather than paying it off.)

Note: Inflation, especially high inflation, can make real rates negative. For example, if inflation is 3%, and Fed rates move up to 2%, then real interest rates are negative: -1%, because 2% – 3% = -1%. If real rates remain negative, the Fed should technically have room to raise rates yet keep monetary policy stimulative.

Consequently, the Fed may try to grow and inflate the government out of its debt hole, [vi] which is now 38.2% of GDP (see Graph 3). Thus it seems inflation is here to stay at a higher rate than what we’ve grown accustomed to over the last two decades; this is what we have been calling StayFlation.

The Fed will raise rates to normalize monetary policy, but realistically, higher interest rates won’t do much to reduce inflation—unless the Fed forces rates up enough to induce a recession—since present price increases have been caused by labor, production, and logistics problems, not by low interest rates[vii]. Higher interest rates won’t solve labor or supply chain issues. The Fed must realize that they are pushing on a string, and that unless they trigger a recession[viii] (which they don’t want), they won’t be able to stem inflation; however, they are loath to publicly admit this. Raising interest rates may normalize monetary policy—so that the Fed has room to lower rates the next time a crisis occurs—but will not reduce the cost of consumer goods and services.

Investment structures that potentially take advantage of market uncertainty and inflationary trends, or reduce market volatility, are worth considering for those who have flexibility. Examples: timely real estate and opportunity zone deals, growth-oriented loans, and credit funds that are somewhat inflation resistant or higher up in the capital structure. We, at Running Point, strive to maintain diversified portfolios that balance cash flow with perceived risks and outlooks. Additionally, where appropriate, we will examine structured deals, venture capital, and growth equity that can take advantage of patient capital. More than a hundred private deals passed into our funnel last year.

Regardless of what happens over the next year or decade, tax, estate, insurance, business, and financial plan preparedness are key to moving beyond the investment outlook and having meaningful family office style preparedness and resiliency. What strategies make the most sense for a family? The short answer: Start with a financial plan, proper estate and trust planning, and tax efficiency. Is private placement life insurance with tax-free growth appropriate? It depends! Each family has different financial circumstances and different family values. At Running Point, we start by listening to gain a clear understanding of your values, goals, and objectives.

Overall, expect long-run aggregate liquidity conditions to remain plentiful and to provide underlying support for businesses and governments. The central banks of the developed economies have invested too much in the post-pandemic recovery to let it all collapse. Continue to expect a prosperous decade ahead, albeit with significant whipsaws and surprises.

Happy new year,

Michael Ashley Schulman, CFA

Partner, Chief Investment Officer

ENDNOTES

[I] The terrible twos are a normal developmental phase of young children (when their wishes aren’t fully understood) that’s often marked by rapid mood shifts, tantrums, defiant behavior, and frustration.

[II] This decision could have huge political and electoral ramifications regardless of which way it goes. At least one side, if not both sides, will be displeased with the eventual ruling (possibly around June 2022).

[III] A developed country is a sovereign state that has a relatively high quality of life, developed economy and advanced technological infrastructure. Most commonly, the criteria for evaluating the degree of economic development are gross domestic product (GDP), per capita income, and general standard of living.

Source: https://en.wikipedia.org/wiki/Developed_country

[IV] The Fed’s past balance sheet peak was a little over four years ago, October 2017, when the Fed started to reduce it from $4.47 trillion to an eventual low of $3.76 trillion at the end of August 2019. In other words, they didn’t get very far. I previously wrote about this approaching problem in 2016: Question the usefulness of some historical stock market statistics

[V] Interestingly, the Bank of Japan (Japan’s central bank), which has engaged in quantitative easing (QE stimulus) for longer than any other central bank, ended QE in May 2021 and has already begun to reduce its holdings of Japanese government securities.

[VI] This only works if annual fiscal deficits (congressional and administrative spending) remain tame. Otherwise, the government’s annual interest payment burden in a rising interest rate environment can become an untenably large percentage of the fiscal budget and crowd out discretionary spending as well as put mandatory spending at risk.

[VII] The Fed has struggled to get inflation above 2% for over a decade. The U.S. has had low interest rates since 2009 with only ho-hum inflation until COVID-19 came along and wreaked havoc with labor and logistics.

[VIII] This is what Fed Chairman Paul Volcker did in 1980–81; raise interest rates fast and high to trigger recession and thereby slash inflation, https://www.federalreservehistory.org/essays/recession-of-1981-82.

Disclosure: The opinions expressed are those of Running Point Capital Advisors, LLC (Running Point) and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Forward-looking statements cannot be guaranteed. Running Point is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Running Point’s investment advisory services and fees can be found in its Form ADV Part 2, which is available upon request. RP-22-01