Governments can rewrite bond rules — WTBF

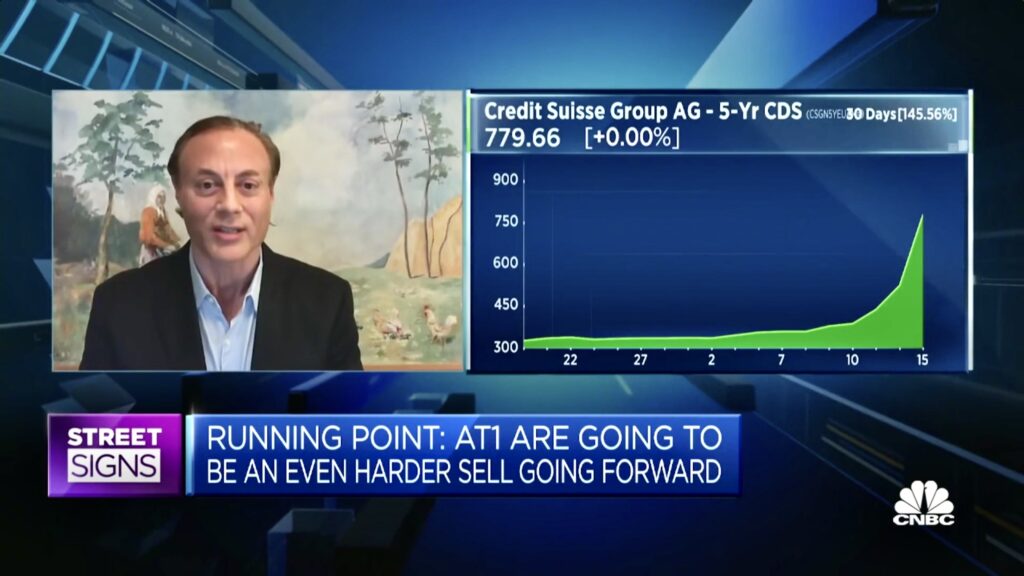

Running Point and its chief investment officer, Michael Ashley Schulman, CFA, were interviewed by Will Koulouris of CNBC Street Signs — in a live TV segment — regarding Swiss regulators writing down over $17 billion of Credit Suisse Additional Tier 1 (AT1) debt to zero and prioritizing shareholders over AT1 bondholders in UBS’s acquisition of the 166 year old bank, Credit Suisse.

Credit Suisse’s AT1 write-off may contribute to a higher cost of capital for banks

Certainly, a contentious issue that Credit Suisse’s Additional Tier 1 (AT1s)—the bail-in bonds—went to zero and the equity received $3 billion of value. Swiss political involvement may have greatly influenced the outcome in this situation vying not to completely wipe out all the individual retail investors and Swiss citizens that owned the equity and also not to completely wipe out the Saudi National Bank’s stake after they took a $1.5 billion or 9.9% stake in Credit Suisse only five months ago in November 2022 as part of the Swiss lender’s $4.2 billion capital raise to fund a strategic overhaul. Additionally, the Qatar Investment Authority had a 6.8% stake and also Norges Bank Investment Management, the sovereign wealth fund of Norway had a 1.5% stake.

The main investors in Credit Suisse’s AT1 bonds—and all other AT1 or contingent collateral (CoCo) bonds—are investment professionals, institutional investors, and hedge funds; i.e., the adults or grownups in the market. AT1 bonds are not the usual domain of individual or retail investors; they are the lowest-ranked bank debt, a legacy of the European debt crisis, and offer attractive returns in good times but take the first hit when a bank has capital problems. The professionals investing in AT1s should have understood the risks, even if that included the Swiss government interpreting capital structure (in an emergency) as they saw fit since CoCo bonds act as financial shock absorbers for a bank only when things go drastically wrong!

The move by Swiss authorities was aimed at protecting the Swiss financial system. It has calmed nerves and bolstered confidence in the short-term, but if a previously $100B bank can be sold for $3 billion, I can’t see how that doesn’t dent overall confidence in the financial system and increase the risk weighting and cost of capital for banks.

The pertinent question is does this alter the European economy’s growth trajectory through tighter credit? Recall that in 2008, stock markets where up a week after Lehman’s demise. But, also 2008 didn’t see bank runs like we see today. When there is a crisis of confidence, it leads to a run!

AT1s or contingent collateral (CoCo) bonds are going to be a harder sell going forward

AT1 bonds are a legacy of the European debt crisis, and are the lowest-ranked bank debt, offering attractive returns in good times but taking the first hit when a bank runs into trouble. Holders of the bank’s AT1 bonds may push back on the regulator’s decision to write off the debt through litigation.

Higher interest rates were both good and bad

A year ago, most bank analysts were encouraging about interest rate raises because they saw net interest margin (NIM) and bank profitability increasing. Obviously, this was a double-edged sword that cuts both ways because it lowered the value of hold to maturity bonds on the balance sheet (especially if they were not hedged to rising interest rates).

China benefits

The rise in global interest rates and concurrent drop in bond prices has affected the balance sheets of many other banks around the globe. To invoke game theory, if no one panics, everything may seem fine; but there seems to be a first mover advantage for anyone who runs from smoke.

On a global scale, Chinese bank stocks have held up well. Industrial and Commercial Bank of China has not been affected and the share price for China Construction Bank has rallied. But U.S. and European banks shares are mostly down and even the Japan Post bank has lost value.

WTBF—Way Too Big to Fail

The larger banks are only going to grow bigger because of this current banking crisis. Too big to fail (TBF) will become Way Too Big to Fail (WTBF). What this means is that down the road, some of these banks may have to become quasi-government agencies and/or the regulators may just live inside the banks (more than they already do).

A brand without trust is just a product, and a product can be replaced.

Keith Weed, CMO, Unilever

Disclosure: The opinions expressed are those of Running Point Capital Advisors, LLC (Running Point) and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Past performance is not indicative of future results. Forward-looking statements cannot be guaranteed. Running Point is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Running Point’s investment advisory services and fees can be found in its Form ADV Part 2, which is available upon request. RP-23-31