Michael’s CIO (Check-It-Out) Report — events, sarcasm, and global macro reflections

February 14, 2024

— Broadcast image clip captured by Yrtist.com

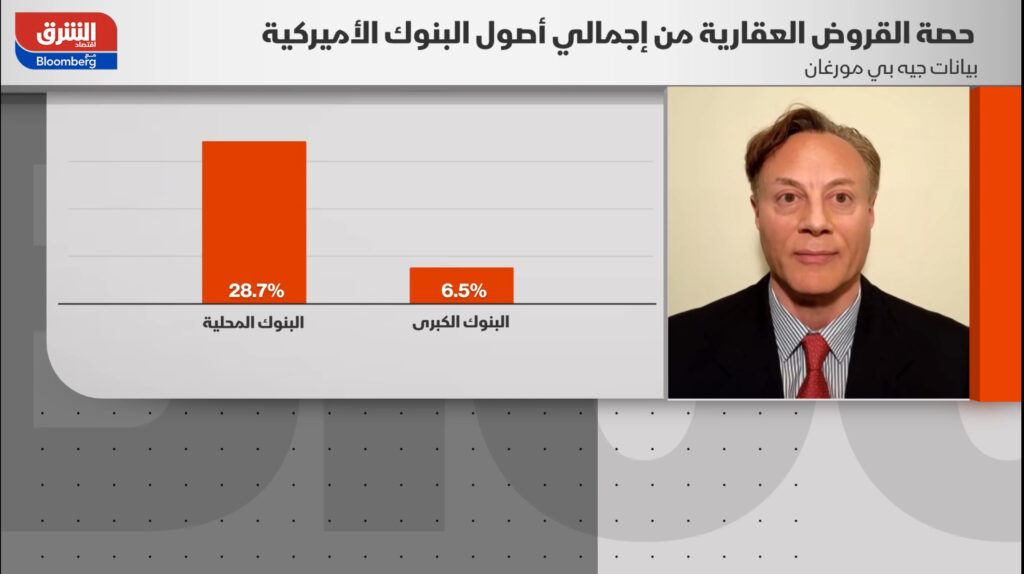

THEME: Commercial and Office Real Estate Investment Outlook

SUMMARY

Over $1 trillion in commercial mortgages will come due in the next 2 years and that is concerning for the banks and private lenders that have commercial buildings on their books; values have tumbled as borrowing costs have climbed and tenants have either left or renegotiated better leases. Commercial property valuations are often slow to adjust to demand shifts and mortgages take years to mature. But since the pandemic began 4 years ago, interest rates have risen sharply, making it tough for building owners to refinance their debt.

BACKGROUND

Running Point‘s chief investment officer, Michael Ashley Schulman, CFA, was interviewed by business news anchor Nour Amache of Asharq Business اقتصاد الشرق News with Bloomberg — in a Tuesday morning live TV segment — regarding our outlook on banks and the global commercial and office real estate sectors in light of recently reported writedowns and losses.

We touched on interest rates, Fed policy, re-financing risks, international and regional banks, the U.S. economy, market expectations, and investment implications! The eight and-a-half minute interview is in Arabic; you can view it here and/or read my take on the situation in English in my notes below. Thank you to Nour Amache, Sarah Al Shawi, and Asharq Business اقتصاد الشرق!

— Broadcast image clip captured by Yrtist.com

AN INTERNATIONAL PROBLEM/OPPORTUNITY

Parts of the commercial real estate (CRE) sector have been challenged over the last couple years and may remain bearish for a while longer because of refinancing concerns, the fallout of New York Community Bancorp, Japan’s Aozora Bank net loss for 4Q23 due partly to bad US real-estate loans, and the potential impact of devalued CRE on regional banks and the financial system as a whole. Most rated banks in Asia-Pacific (APAC) have much lower levels of US CRE exposure than small US banks. Where disclosed, APAC banks’ exposure to US property, including CRE, is generally less than 2% of lending, however many banks do not break out the percentage. Shanghai Commercial Bank Limited’s exposure to the US market is nearly 30% but they don’t disclose how much of that is CRE. In Asia, the main headwinds will come from local CRE risks faced by Hong Kong Banks and Korea’s Woori Financial Group. Systemic risk here seems unlikely, but ratings downgrades could be expected.

THE OFFICE

Office—which is the most troubled CRE sector—represents about 20% of the commercial RE market and office vacancy is approximately 20%. Typical office leases last 5 to 10 years, so demand changes usually unfold slowly over time. However, space available for sub-leasing is up huge and creating faster changes.

THE FED

Central bank interest rate cuts and lower bond yields would significantly aid the CRE market and create tailwinds. But those expecting the Federal Reserve to swiftly and severely cut interest rates may be sorely disappointed! The economy is growing, uemployment is low, and inflation remains stubbornly above 2%; therefore Jerome Powell and the Fed have little reason to reduce interest rates. Some economists are projecting the equivalent of seven interest rate cuts in 2024, but even as many as three 0.25% interest rate cuts this year may be wishful thinking. Additionally, property owners seeking to refinance mortgages that were done in countries that previously had negative interest rates may be in dire straits.

REITs vs BANKS

Vornado Realty Trust, a REIT with high NY, Chicago, and San Francisco exposure, bottomed in May of 2023 whereas NYCB cratered a few days ago. Which indicator is more prescient?

Some re-pricing has already occurred but has not completely flowed through the system because of a lack of transactions. Thankfully, the macro backdrop seems to be improving rather than deteriorating; unemployment is low, GDP growth is 3.3%, and economic growth has not been impaired by the financial woes of regional banks because private credit has picked up the slack. The Green Street CRE Index is down 22% from its peak and regional bank share prices are down 35%.

HERE ARE THE KEYS

Office real estate faces interest rate risk and consequently refinancing risk, but not tenant credit risk. Demand has softened, but tenants are not going bankrupt like they did in the great financial crisis (GFC).

Buildings that previously sold for $60MM and have $30 to $35MM of debt may be handed back to the bank who will just look to recover its loan amount. In other words, you may be able to buy an office building at close to ½ its previous sale price.

My suggestion, become friends with the banks😉

OFFICE REAL ESTATE IS BEING HIT BY FIVE FORCES

- Empty Offices: Post pandemic, people and businesses are not fully returning to the office; they have learned to work remotely, and many are doing it effectively and efficiently

- Lingering Risk: If there is another recession or pandemic, office will just be shortened to three letters, off. No company wants to be again locked into leases they can’t support

- Refinancing Trouble: Interest Rates and inability to refinance

- Artificial intelligence, AI: Many office businesses are going to be able to make do with less people because of AI efficiencies, thus further reducing the need for office space

- China syndrome: Selling by Chinese investors needing to shore up their finances at home

BOTTOM FISHING

To successfully bottom fish, you need to buy cheap, go where the people are, and under leverage

- Buy cheap—sometimes even without financing—in other words, ask whether the property make sense if bought for all equity?

- Go where the people are; e.g., suburban retail real-estate for convenient shopping and services; lab space because that can’t be done remote, warehouses, data and server infrastructure, luxury resorts (i.e., that are not dependent on business travel)

- Under leverage; If rates go down you can refinance; if rates go up, you don’t lose the property

Focus on cost basis advantages relative to the market, seek an identifiable “margin of safety”.

- Use qualitative and quantitative metrics such as location, product, stabilized yield, and per square foot basis to measure advantages.

- Focus on margins without reliance on market trends.

✓ Minimize business plan complexity to improve the probability of success.

- Identify and exploit capital efficient solutions to maximize ROI.

- Carefully structure leverage to minimize downside exposure in the event of business plan or market challenges.

OFFICE IS NOT DEAD, BUT IT IS SHIFTING

Here are 4 office trends

- Class A: Those that need it want class A space; there is a bifurcation of demand with newer high-end buildings and amenities attracting tenants at the expense of outdated and low amenity properties

- Buy don’t rent: Many businesses will look to take out SBA loans and buy a building

- Convenience: Suburban office space with drive up parking (instead of underground or garage parking) is preferred

- Cash on the sidelines: There are huge piles of institutional and family office cash on the sidelines waiting to snap up deals; prices will be low, but patient capital that is willing to sit on the structures will help set a floor for valuations

Additionally, watch out for possible over-supply (not just now, but in 7 to 10 years when you want to sell), unsupportive or changing local government regulation, shifting demographics, fluctuating weather patterns, and rising property casualty insurance costs.

STRATEGIES

Possible investment strategies to take advantage of dislocated valuations and finances include rescue capital, distressed acquisitions, selective development, platform investment, and the use of real estate options.

- Rescue Capital: During periods of capital market volatility and scarcity, makes rescue capital investments, such as participating preferred equity, that can create opportunistic return profiles with added downside protection from capital subordination

- Distressed Acquisitions: Assets go through cycles in both market demand and physical obsolescence. Target and reposition quality assets that are in temporary distress due to investor sentiment or under-investment

- Selective Developments: Seek development opportunities with a built in developer profit, “margin of safety.” Counter intuitively, this can work best in down cycles, when both construction cost and competitive supply tend to abate

- Platform Investments: That create substantial value for investors by widening real estate margins through operational efficiencies and driving equity value creation through earnings growth

- RE Options: Use option contracts to create substantial upside opportunity from re-entitling property. Options work to hedge entitlement risk by reducing exposure to owned land, while retaining the enormous value creation unlocked by a successful re-entitlement

One or more of the above may be viable depending on real estate conditions and the politicaland economic environment.

— Broadcast image clip captured by Yrtist.com

NEXT STEPS

Consider a strategy of investing in real estate sectors that have strong tailwinds, capitalizing on distressed situations and aggregating portfolios in fragmented markets. Generate opportunistic returns by investing in assets that exhibit significant return potential while limiting downside or principal loss, with advantageous capital structures, loan-to-own safety-nets, and other risk-adjusted real estate investment terms within business friendly states.

Make it a great week😃,

Michael

~~~

Michael Ashley Schulman, CFA

Partner & Chief Investment Officer

Running Point Capital Advisors, your family office

“We deliver custom investment solutions, family office services, innovations, and unique perspectives to you and your family—we are your family office—you can emphasize your enjoyments, priorities, and legacy.”

Disclosure: The opinions expressed are those of Running Point Capital Advisors, LLC (Running Point) and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Forward-looking statements cannot be guaranteed. Running Point is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Running Point’s investment advisory services and fees can be found in its Form ADV Part 2, which is available upon request. RP-24-23