NVIDIA’s forecast is riding the Blackwell rack ramp and the hyperscaler shopping spree

“NVIDIA maintains its attractiveness, and investment funds are betting on growth—August 27, 2025—NVIDIA’s latest results revealed continued growth, driven by the data center sector, albeit falling short of expectations by a small margin. Michael Ashley Schulman, chief investment officer at Running Point Capital, believes its market value remains justified by the growing demand for artificial intelligence, with investment funds betting on expansion in chips and software.”

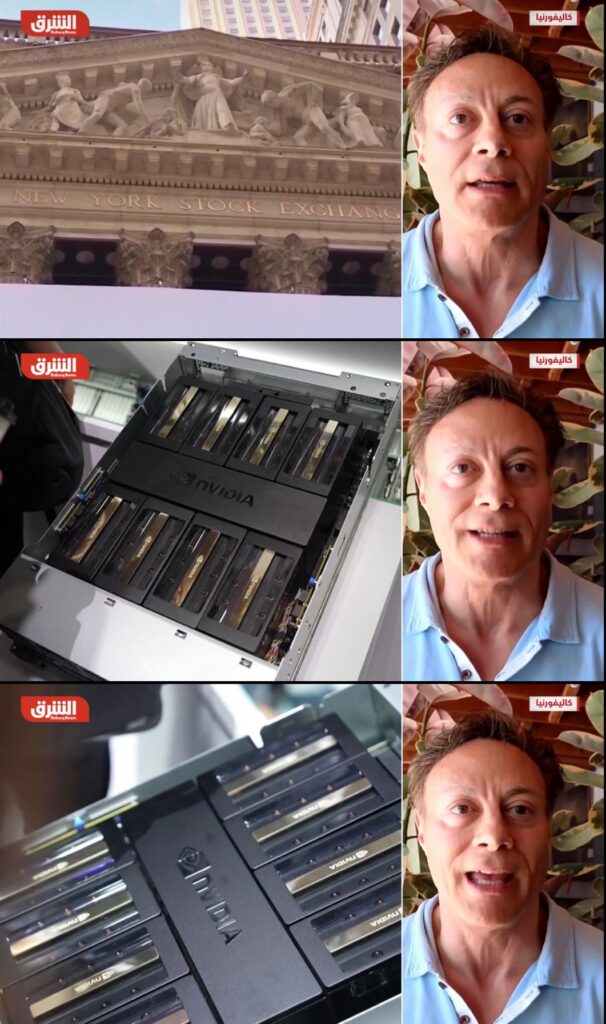

Wednesday afternoon in California/Thursday morning in Dubai, we were interviewed live regading our thoughts on NVIDIA’s earnings, outlook, and management commentary on Asharq Business اقتصاد الشرق with host Hadjer Bioud هاجر بيوض. Special thanks to producer Janti Hajhasan.

OUR THOUGHTS

The S&P 500 closed at a record high on Wednesday, so expectations were strong for Nvidia and AI in general as we walked into this earning report. We all knew growth would decelerate, the question was how much?

Whether Nvidia keeps growing at 30% or 50% makes a big difference in how analysts calculate current value. DECELERATION was a given, but how severe will the leveling off be? If China sales resume, Nvidia could see a nice uplift especially since it’s not in management’s forecast.

If this was a blowout quarter, nothing else would matter. But this was just a good solid quarter, didn’t beat expectations, but numbers were fine! So now WHAT REALLY MATTERS is the Federal Reserve September FOMC meeting, because if they lower rates by a quarter to half percent, it’s off to the races again for growthy tech names. Massive datacenter buildouts and corporate investment become much more affordable.

NVIDIA’s forecast is riding the Blackwell rack ramp and the hyperscaler shopping spree while getting nagged by high bandwidth memory supply, networking scale, and the joyless physics of power and cooling that make data centers feel like SimCity game on nightmare mode💀

Management still pointed to a stronger back half, kept the margin improvement goal in sight, guided third quarter revenue near $54 billion , and greenlit a $60 billion buyback which is management’s way of saying we like our own cooking, and they still had $14.7 billion remaining under its previous repurchase plan at June 30th.

Investors are contrasting the beat on total revenue and earnings per share with a hairline miss in data center revenue; WHAT THEY SHOULD BE WATCHING is whether full rack shipments stay on schedule, how the mix shift from chips to systems and software shapes margins, and whether the demand curve looks durable once the first generation of artificial intelligence clusters is bolted to the floor.

Management is executing PLATFORM not parts as the team talked up robust Blackwell demand and a clean roadmap toward RUBIN which matters because it turns a chip cycle into a multi-year compute utility, raises switching costs for customers, and makes the moat look less like a trench and more like an inland sea.

Gallery of Photos

~~

Running Point—We “run point” on all things financial for you and your family.

🟠Personalized tax planning, estate planning, investing, wealth management

🟠We are your family office.™️

🟠Life Insurance Done Smart™️(LIDS) is our in-house PPLI and PPVA managed separate accounts program!

~~

Disclosure: The opinions expressed are those of Running Point Capital Advisors, LLC (Running Point) and are subject to change without notice. The opinions referenced are as of the date of publication, may be modified due to changes in the market or economic conditions, and may not necessarily come to pass. Forward-looking statements cannot be guaranteed. Running Point is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Running Point’s investment advisory services and fees can be found in its Form ADV Part 2, which is available upon request. RP-25-211